As the world intensifies its focus on addressing climate change, private climate finance is emerging as a crucial player in the fight against environmental degradation. With trillions of dollars needed to transition to a sustainable economy, private investments are essential for scaling up climate initiatives. However, navigating this complex landscape requires careful consideration. Here are four key factors to keep in mind when engaging with private climate finance.

1. Understanding the Landscape of Climate Investments

The private climate finance ecosystem encompasses a wide array of investment options, including green bonds, impact investing, and venture capital for clean technologies. Understanding the various instruments available is essential for investors looking to align their portfolios with climate goals.

Investment Instruments:

- Green Bonds: These are debt securities specifically earmarked for funding environmentally friendly projects. They provide investors with a way to support climate initiatives while earning returns.

- Impact Investing: This approach focuses on generating positive environmental and social impacts alongside financial returns. Investors in this space often target sectors such as renewable energy, sustainable agriculture, and energy efficiency.

- Venture Capital: Startups developing innovative technologies for climate solutions often rely on venture capital funding. Investing in these companies can yield high returns while contributing to sustainability.

2. Evaluating Risk and Return

Investing in climate finance is not without risks. It’s crucial for investors to evaluate the potential financial returns against the inherent risks associated with climate-related investments.

Risk Factors to Consider:

- Regulatory Changes: Climate policies are evolving rapidly, and shifts in regulations can impact investment returns. Staying informed about potential policy changes is vital.

- Market Volatility: Many climate-related investments, particularly in emerging technologies, can be subject to market fluctuations. Understanding the volatility of specific sectors can help in making informed decisions.

- Technology Risks: Innovations in the climate space can carry risks related to their commercial viability. Thorough due diligence is necessary to assess the potential success of new technologies.

3. Measuring Impact

Investors increasingly seek to measure the environmental and social impacts of their investments. Establishing clear metrics is crucial for evaluating the effectiveness of climate finance initiatives.

Impact Measurement Approaches:

- Environmental Performance Indicators: Metrics such as carbon emissions reduction, energy efficiency improvements, and biodiversity enhancement can provide insights into the effectiveness of investments.

- Social Impact Assessment: Evaluating the social implications of investments—such as job creation, community engagement, and social equity—ensures a holistic approach to measuring impact.

- Third-Party Certifications: Utilizing standards and certifications from reputable organizations can help validate the environmental claims of projects and provide reassurance to investors.

4. Building Partnerships and Collaborations

Collaboration is key to unlocking the full potential of private climate finance. Engaging with a range of stakeholders—from governments and NGOs to other investors—can enhance the effectiveness of climate initiatives.

Benefits of Collaboration:

- Resource Sharing: Partnerships can facilitate the sharing of resources, knowledge, and best practices, leading to more impactful investments.

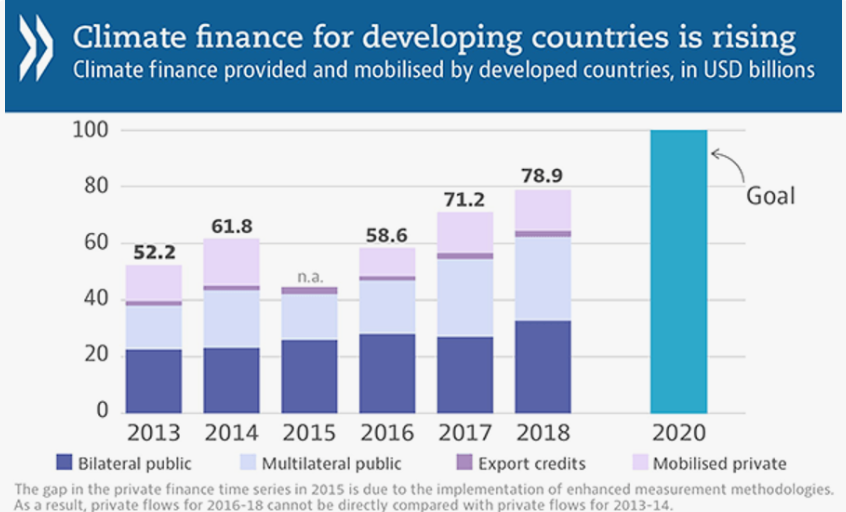

- Leveraging Public Funds: Collaborating with public sector entities can help leverage additional funding and support for climate projects, amplifying the impact of private investments.

- Creating a Network: Building relationships within the climate finance community can open doors to new opportunities, insights, and innovations.

Conclusion: A Path Forward for Private Climate Finance

Private climate finance represents a vital avenue for mobilizing the capital necessary to address the pressing challenges of climate change. By understanding the landscape, evaluating risks and returns, measuring impact, and fostering collaborations, investors can navigate this complex arena effectively.

As the urgency to tackle climate issues intensifies, engaging in private climate finance not only aligns with global sustainability goals but also presents opportunities for financial growth. With thoughtful consideration and strategic action, private investors can play a pivotal role in driving the transition to a low-carbon economy, ensuring a sustainable future for generations to come.